Form I-9 Best Practices for Restaurant Managers

Form I-9

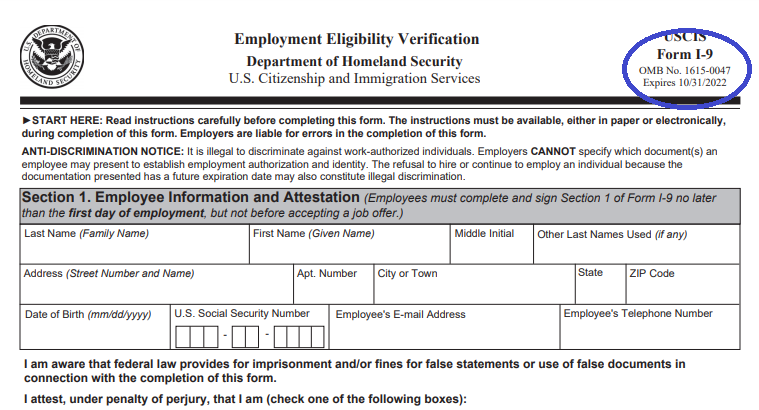

In restaurants, one aspect of HR management that often falls by the wayside is new hire paperwork. Managers are busy and the training window often so pressed, that key documents can be mistakenly left incomplete or completely absent. Regardless of a full schedule, certain new hire documents should be seen as nonnegotiable to complete. One such document is Form I-9. The I-9 is used to verify an employee’s eligibility to work in the United States and incomplete or missing forms can wield hefty fines from the government. This two-page form is relatively easy to complete but there are some best practices that can be implemented to help aid in this process.

THE BASICS

Use the latest version of the form.

The I-9 was created in the 80’s so there are many past versions of this form. However, the best practice is to use the latest version for new employees. The most recent version expires 10/31/2022. This date is located in the upper right-hand corner of the form itself. If you have an employee who was hired before this form, you DO NOT need to complete a new form. Meaning, a long-term employee who completed their I-9 in 2004 should not be made to redo this form.

Have the employee complete section one on their first day of employment (not before).

Employees should complete this form on their first day of work not before. The reason for this is that having the employee complete before can be seen as discriminatory as it could be used to potentially screen out certain categories of employees.

Complete the employer section no later than 3 days after the employee’s first day.

To complete this section, your employee needs to provide either ONE document from list A or a document from List B AND List C. Your responsibility as the employer is to examine the document(s) and place them in the proper section of the form. You do not need to be a document expert to do this, just confirm that they look reasonably authentic. If your employee does not present documents within 3 business days, they should not be allowed to work (but they should still be compensated for the time they did work in the event of termination).

Do not request the employee bring certain documents.

This practice can be seen as discriminatory. Instead, provide the employee with the list of acceptable documents (page 3 of the form I-9).

SOME ADDITIONAL CONSIDERATIONS

Use N/A in lines that do not have an answer in section 1.

To properly complete this form, N/A should be put in boxes that have no information. For instance, in section one, if the employee does not have any “other names used”, they should put an N/A in that section.

Include the employee info from Section 1 in Section 2 of the form.

At the top of page 2 there are boxes to put the employee last name, first name and citizenship/immigration status. These boxes can be easily missed as they blend into the grey instruction box at the top.

Documents should be recorded in their proper columns.

This is especially relevant if an employee brings a document from List B and C. List B documents confirm identity and List C documents confirm employment authorization. It is important that these documents are recorded properly. Don’t be afraid to reference the List of Acceptable Document page to determine where things should be listed. Additionally, if an employee brings a document from List A, no documents should be recorded in List B or C, even if they brought something from those columns. For example, if an employee brings a passport and a driver’s license, only the passport should be recorded on the I-9 form. This is because List A documents confirm both identity and right to work and additional document is not needed to confirm their status. Over-documenting can be seen as discriminatory and should be avoided.

Keep your I-9s in a separate folder

I-9s are best kept in their own folder alongside employee files. This makes them easier to access in the event you need to produce the forms and can prevent your business from having to hand over all your employee files. Another benefit of this practice is that it makes it easier to sort through this file when it is time to get rid of old forms. The federal regulation for the retention of Form I-9 is 3 years after the date of hire OR one year after the date employment ends, whichever is later.

KEY TAKE-AWAYS

It is critical for your restaurant to complete form I-9 when you bring on a new employee. This certifies an employee’s eligibility to work in the United States and must be completed to ensure your business’ compliance with government regulations. Following the above best practices can help protect your business. If you have additional questions about I-9 best practices, reach out to us at hr@vinesolutions.com or check out our HR Services. Here is the link to the current version of the Form I-9.